The psychology of purchasing decisions

On the surface, purchasing decisions appear to be simple. We purchase what we need and want, based on price, quality and availability. But underneath the

On the surface, purchasing decisions appear to be simple. We purchase what we need and want, based on price, quality and availability. But underneath the

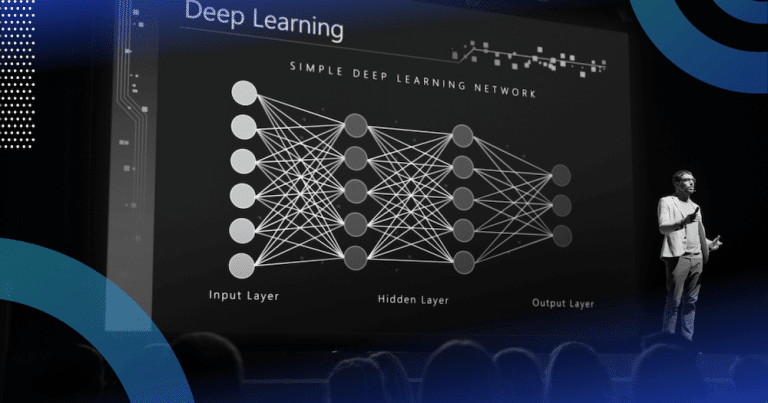

Deep learning is all the rage today, as major breakthroughs in the field of artificial neural networks in the past few years have driven companies

Typically we explain taste—in food, music, movies, art— in terms of culture, upbringing, and sheer chance. In what we buy often the same applies. It

When it comes to customer experiences, the landscape is changing—quickly. Significant shifts are redefining how companies engage with their clients. The era of “one size

The ecommerce landscape is undergoing a significant transformation. Consumers are increasingly turning to online channels for their shopping needs, demanding convenience and a hyper-personalised experience.

New Survey of 2,000 Consumers in North America Reveals that 41% Would Like to Hear From Brands Weekly—and 32% Say They Will Shop Elsewhere if

It’s no secret that hyper personalisation creates better digital experiences that drive better business outcomes. That includes more consumer interactions, more sales, and more revenue.

It’s no secret that personalisation drives engagement. Today’s marketers also know that AI can power hyper-personalisation. But many are struggling to effectively deploy it, specifically

When you’ve been browsing a website, seen and bought a few things you like, and when they email you it’s like someone has been reading

The decision to embrace AI hyper-personalisation is not just a matter of adopting new technologies. It forces companies to reimagine their content supply chain to

Among the great challenges posed to democracy today is the use of technology, data, and automated systems in ways that threaten the rights of the

The resurgence of AI has industry leaders counting the days until quantum computers go mainstream. There’s been considerable progress on the quantum computing front since

On 6th February 2024, the UK Government unveiled its long-awaited response to last year’s White Paper consultation on regulating Artificial Intelligence (AI). As expected, the Government’s “pro-innovation”

Quantum AI combines the power of quantum computing with the algorithms of artificial intelligence (AI). It enables technologies to solve problems exponentially faster and in

The marketing world is dynamic and ever-changing. The latest trends, technologies, and tactics are never stagnant. Keeping an eye on the newest marketing statistics is

In the realm of technology, 2024 promises not just an evolution but a revolution—a transformative era where Artificial Intelligence (AI) transcends boundaries, reshaping the way

Following ever-growing adoption of artificial intelligence in ecommerce marketing, the distinction between personalisation and hyper-personalisation has become ever more important. Indeed, some might argue that

Imagine you visit two different websites for companies in the same industry. One offers you three choices, while the other presents 15 varied options. Which