Marketing techniques for transforming consumer spending habits. To help the decision on which technique to choose, we expanded upon the short labels you see in the graph to help scope the response more carefully.

For example, ‘Big Data’ is a nebulous term, but when we expanded the definition to include insight and predictive analytics, it shows the value of the specific marketing techniques for Big Data and this help explains why this is in position number two. Here is the full listing of digital marketing techniques:

- Big Data (including market and customer insight and predictive analytics)

- Content marketing Communities (Branded niche or vertical communities)

- Conversion rate optimisation (CRO) / improving website experiences

- Display (Banners on publishers, ad networks social media including retargeting and programmatic)

- Internet of Things (IoT) marketing applications

- Marketing Automation (incl CRM, behavioural Email marketing and web personalisation)

- Mobile marketing (Mobile advertising, site development and apps)

- Paid search marketing, e.g. Google AdWords Pay Per Click

- Online PR (including influencer outreach)

- Partnerships including affiliate and co-marketing

- Search Engine Optimisation (SEO or organic search)

- Social media marketing including Social CRM and Social Customer Care

- Wearables (e.g. Apple Watch, activity trackers, augmented reality)

We simplify digital marketing down to just 8 key techniques which are essential for businesses to manage today AND for individual marketers to develop skills. This visual shows the core techniques which will drive more leads and sales for you, but within some sectors, techniques like using AI, IoT, Wearables will be more important.

The Top 14 marketing techniques

Let’s now drill down into the key tactics and marketing technology within each of these tactics which will be important this coming year.

1. Content marketing trends

Content marketing has been in the top 3 for the last 3 years we have run this post, so we focus a lot on how to create an integrated content marketing strategy.

Our research with HubSpot shows that more businesses are now using a strategic approach (40%), so this is a trend we can expect to see continuing in 2017. We can also expect that there will be more focus on Measuring Content Marketing ROI as the cost and competition within content marketing increases.

2. Big Data

Big Data marketing applications include market and customer insight and predictive analytics.

The 3Vs of Big Data shows why this is a key trend selected by many, who have experienced the increase in volume, real-time data and data formats in their business and want to exploit the value to increase sales through personalisation on websites and through email marketing through predictive analytics – a topic we have covered many times on our blog. It’s also closely tied into machine learning where Big Data is mined to identify propensity to convert given different customer characteristics and behaviour.

3. Marketing Automation (including CRM, behavioural email marketing and web personalisation)

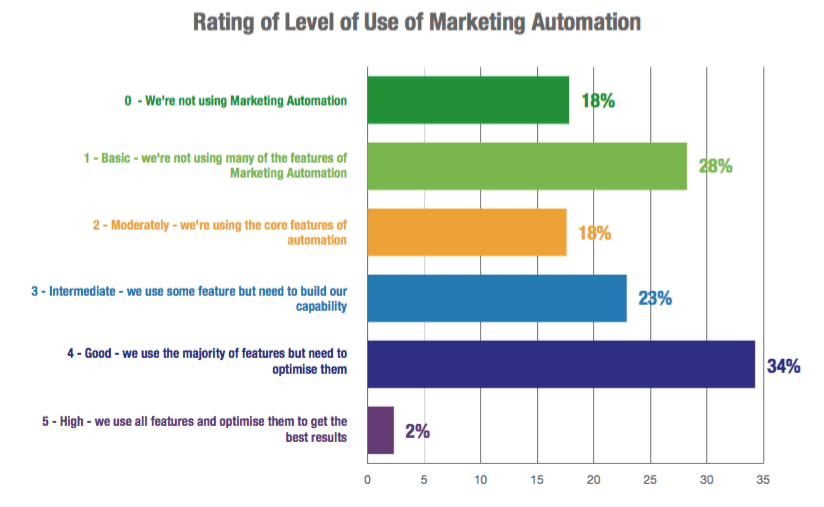

Like content marketing, marketing automation has been in the top 3 for the last 5 years we have asked this question. Many businesses still have the potential for improving their automation.

As businesses progress up the learning curve more businesses will be putting lead scoring in place, or refining it and learning the best places on the journey to feature content through predictive analytics.

4. Mobile marketing (Mobile advertising, site development and apps)

Mobile was in the top 3 three years ago, but as more companies have adopted mobile responsive web design and email templates they have seen less need to focus on it, or at least there are fewer opportunities for growth.

However, research shows that retail conversion rates are significantly lower on a smartphone, so there is work to be done for many businesses to optimise conversion on mobile, although they will likely always stay lower than desktop.

Mobile also has a large impact on search marketing as Google vigorously follows its mobile-first mantra. It’s a somewhat misleading mantra since the reality is that many web users are still using a desktop, laptop and tablet devices and there is a danger with mobile responsive designs that conversion on higher resolution screens may fall if mobile optimised. Instead, leading companies are looking at adaptive mobile design approaches which have the benefit of serving more relevant, contextual content and CTAs for users and reducing load times.

‘Mobile first’ is also misleading if we look at the overall customer journey since often different devices may be involved at different points. So a better vision for the mobile strategy is treating it as part of a multiplatform or multichannel strategy. As this data from comScore highlight, the multiplatform ribbons for all countries are much broader than users who are mobile-only or desktop only.

5. Social media marketing including Social CRM and Social Customer Care

Continued growth in social media usage overall, but with reduced popularity of some social networks in some countries. For example, Twitter and Facebook are in decline or plateauing in many western markets while Snapchat, Instagram and Pinterest are still growing in usage.

Trends in social media marketing are often controlled by the efforts of the social networks to monetise and this has seen Facebook and Instagram, in particular, make changes such that businesses now need to ‘pay to play’ to get the reach needed to have an impact. They have continued to innovate in their targeting and remarketing options.

6. Conversion rate optimisation (CRO) / improving website experiences

It’s higher in popularity than previous years, but many businesses are missing out on a more data-driven approach to increase leads and sales from their websites.

It a great way to show the need to test extensively since only a third have a positive test. It also shows how competitors may be getting ahead if they are testing more extensively.

7. Internet of Things (IoT) marketing applications

IoT is one of the most important marketing technology applications of the last 2-3 years, but it is of most relevance to devices makers and retailers, so it is relatively high-up in this ranking of priorities.

There are expected to be 75 billion connected devices by 2020, meaning there will be ten times as many devices able to talk to one another as there will be people on the planet! The implications are huge and far-ranging. All this sharing of data will transform the way we live our lives.

8. Search Engine Optimisation (SEO or organic search)

Mobile marketing SEO techniques will be particularly important in 2017 with Google’s recent announcements about the mobile index and AMP. We have seen huge increases in AMP smartphone traffic since September 2016 when Google rolled AMPs out beyond Google News. AMPs are targeted at publishers.

9. Wearables

Wearables are one of the hottest consumer consumable commodities (e.g. Apple Watch, activity trackers, augmented reality)

10. Paid search marketing

Google AdWords is the most important form of Pay Per Click and here Google has been pursuing their ‘Mobile-first’ strategy by building out these features.

11. Online PR (including influencer outreach)

Online PR today is inextricably linked with Content marketing, SEO and Social media, or it should be. But this doesn’t get a top rating since the others are important.

12. Communities

These are branded niche or vertical communities.

13. Display advertising

This includes banners on publishers, ad networks social media including retargeting and programmatic.

14. Partnerships including affiliate and co-marketing

A neglected aspect of digital marketing, perhaps unsurprisingly unsexy.

Other trends

This is an interesting category since readers can tell us what we’re missing. Suggestions here include:

- Account-Based Marketing (ABM) – relevant for B2B marketers targeting large accounts we have a new guide in our B2B toolkit on this early in the new year.

- Digital OOH (Out-of-home) – A surprising one for the number one technique

- Employee advocacy and feedback – interesting to see the internal marketing perspective – again surprising to see as the main growth point

- Machine Learning – as mentioned at the top of the article

- Omnichannel and multichannel attribution – both good for reminding us that it is the way that these channels work together to support each other that is often most important – the reason why many members are looking for advice on an integrated marketing strategy.